Equity LifeStyle Properties, Inc. (NYSE:ELS) Rating Changed by Nisa Investment Advisors LLC

Nisa Investment Advisors LLC decreased its holdings in Equity LifeStyle Properties, Inc. (NYSE:ELS – Free Report) by 1.2% during the 2nd quarter, according to the company in its most recent filing with the SEC. The fund owned 71,785 shares of the real estate trust’s stock after selling 885 shares during the quarter. Nisa Investment Advisors LLC’s holdings in Equity LifeStyle Properties were worth $4,710,000 as of its most recent SEC filing.

Nisa Investment Advisors LLC decreased its holdings in Equity LifeStyle Properties, Inc. (NYSE:ELS – Free Report) by 1.2% during the 2nd quarter, according to the company in its most recent filing with the SEC. The fund owned 71,785 shares of the real estate trust’s stock after selling 885 shares during the quarter. Nisa Investment Advisors LLC’s holdings in Equity LifeStyle Properties were worth $4,710,000 as of its most recent SEC filing.

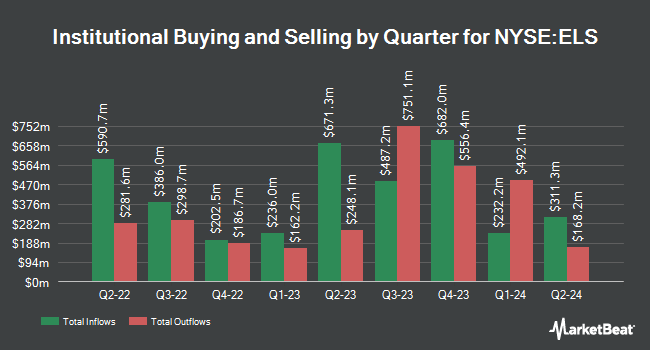

A number of other institutional investors have also recently modified their positions on the company. Mather Group LLC. acquired a new position in Equity LifeStyle Properties in the 1st quarter worth approximately $25,000. Rise Advisors LLC bought a new stake in Equity LifeStyle Properties in the 1st quarter worth about $27,000. V Square Quantitative Management LLC acquired a new stake in shares of Equity LifeStyle Properties during the second quarter valued at $30,000. Blue Trust Inc. boosted its stake in shares of Equity LifeStyle Properties by 167.1% during the second quarter. Now Blue Trust Inc. now owns 625 shares of the real estate agent’s stock valued at $40,000 after buying an additional 391 shares during the period. Finally, Headlands Technologies LLC grew its holdings in shares of Equity LifeStyle Properties by 143.8% during the fourth quarter. Headlands Technologies LLC now owns 624 shares of the real estate developer’s stock valued at $44,000 after acquiring an additional 368 shares in the last quarter. Institutional investors own 97.21% of the company’s stock.

Equity LifeStyle Properties Stock Performance

NYSE:ELS opened at $70.84 on Tuesday. The firm has a market capitalization of $13.21 billion, a PE ratio of 38.71, a PEG ratio of 4.06 and a beta of 0.77. Equity LifeStyle Properties, Inc. It has a 1 year low of $59.82 and a 1 year high of $74.04. The company has a current ratio of 0.03, a quick ratio of 0.03 and a debt-to-equity ratio of 0.34. The firm’s fifty-day moving average is $66.66 and its 200-day moving average is $65.03.

Equity LifeStyle Properties (NYSE:ELS – Get the Free Report ) last released its quarterly earnings results on Monday, July 22nd. The real estate brokerage reported $0.42 earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of $0.65 by ($0.23). The firm had revenue of $380.00 million for the quarter, compared to the consensus estimate of $334.53 million. Equity LifeStyle Properties had a net return on investment of 23.56% and a return on equity of 23.71%. The company’s revenue was up 2.7% year-on-year. In the same quarter last year, the company earned $0.66 per share. On average, sell-side analysts expect that Equity LifeStyle Properties, Inc. it will post 2.91 EPS for the current year.

Equity LifeStyle Property Increases Dividends

The firm also recently announced a quarterly dividend, which will be paid on Friday, October 11th. Stockholders of record on Friday, September 27th will be given a dividend of $0.4775 per share. The ex-dividend date is Friday, September 27. The highest dividend yield of Equity LifeStyle Properties shares in the total of two shares is $0.48. it paid shares of 1.91 $ in total and the annual yield was 2.70 %. The payout on Equity LifeStyle Properties is 104.37%.

Wall Street Analysts Forecast Growth

Several research firms have recently commented on ELS. Evercore ISI increased their price objective on Equity LifeStyle Properties from $69.00 to $72.00 and gave the stock an “in-line” rating in a report on Tuesday, July 23rd. Royal Bank of Canada restated a “sector perform” rating and set a $68.00 price objective on shares of Equity LifeStyle Properties in a research report on Wednesday, July 24th. Truist Financial upped their price objective on shares of Equity LifeStyle Properties from $65.00 to $70.00 and gave the company a “hold” rating in a research note on Tuesday, July 30th. Finally, Barclays dropped their target price on shares of Equity LifeStyle Properties from $78.00 to $72.00 and set an “overweight” rating on the stock in a research report on Friday, April 26th. Eight investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. According to MarketBeat, the stock has an average rating of “Hold” and a price target of $68.94.

Find our latest Research Report on Equity LifeStyle Properties

Company Profile of Equity LifeStyle Properties

(Free Report)

We are an independent real estate investment trust (REIT) headquartered in Chicago. As of January 29, 2024, we own or have an interest in 451 properties in 35 provinces and British Columbia with 172,465 properties.

Read more

Get News and Information on Equity LifeStyle Properties Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Equity LifeStyle Properties and related companies with MarketBeat ‘s FREE email newsletter. com.

#Equity #LifeStyle #Properties #NYSEELS #Rating #Changed #Nisa #Investment #Advisors #LLC